Ever filled out a loan application only to get that sinking feeling that you’ve just hurt your credit? You’re not alone. In the world of online lending, understanding how your credit score is used is half the battle. This is where platforms like Traceloans.com enter the picture. When you hear “traceloans.com credit score,” it’s natural to wonder: is this a helpful tool or a hidden risk?

Imagine a marketplace that lets you peek at your potential loan options without the commitment, like window-shopping for a car. That’s the promise of services like Traceloans.com. They specialize in providing a safe, no-impact way to see if you prequalify with their network of partner lenders. But the crucial detail, the one that protects your financial footprint, is knowing exactly how they interact with your credit score. Let’s pull back the curtain.

Why Your Credit Score is Your Financial Handshake

Think of your credit score as your financial reputation in a number. It’s the first thing most lenders look at to decide if you’re a reliable borrower. A higher score can open doors to better interest rates and more loan options, while a lower one might make things trickier.

When you apply for a loan, lenders need to assess this risk. They do this by performing a credit check. However, not all credit checks are created equal, and this is the most important concept you need to understand when using any comparison service.

The Two-Tone Truth: Soft Pulls vs. Hard Pulls

This is the core of the “traceloans.com credit score” question. The impact on your score boils down to two types of credit inquiries.

The Soft Pull (The Gentle Look)

- What it is: A superficial check of your credit report.

- The Impact: None. It’s like a lender glancing at your public financial profile.

- Who sees it: Only you. These inquiries do not show up to other lenders and do not affect your credit score.

- Common Uses: Pre-qualification offers, background checks, and checking your own score.

The Hard Pull (The Deep Dive)

- What it is: A full credit check initiated when you formally apply for credit.

- The Impact: Can temporarily lower your score by a few points. It signals to other lenders that you might be taking on new debt.

- Who sees it: Any company that checks your credit report. Multiple hard pulls in a short time can look risky.

- Common Uses: Final approval for loans, credit cards, and mortgages.

How Traceloans.com Navigates Your Credit Score

So, where does Traceloans.com fit in? The key value of a loan-comparison marketplace is its ability to use a soft pull for the initial prequalification process.

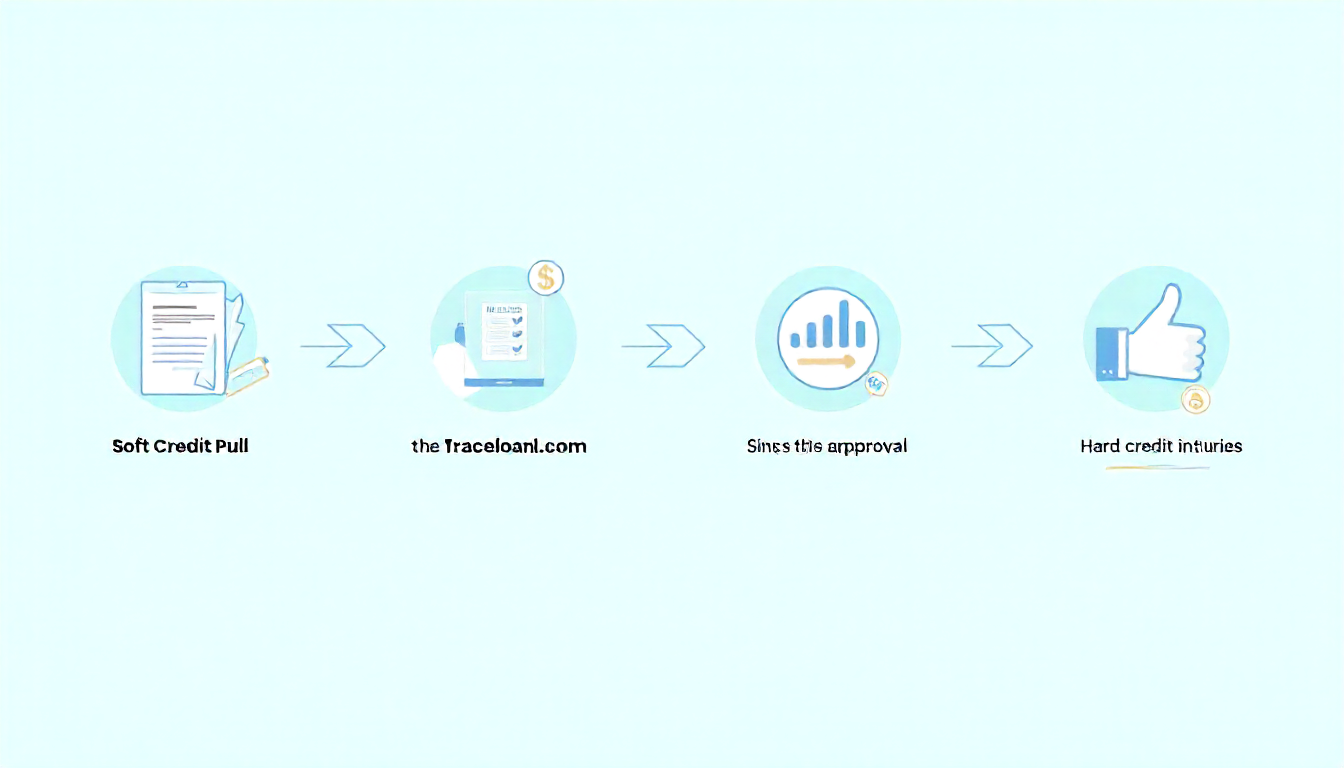

Here’s how it typically works:

- You Provide Basic Info: You enter some details on the Traceloans.com website to see what offers you may qualify for.

- The Soft Pull Happens: Traceloans.com, or its partner lenders, perform a soft credit inquiry. This does not affect your credit score.

- You See Your Options: You’re presented with a list of potential loan offers, rates, and terms from various lenders based on that soft pull.

- You Choose & proceed: If you see an offer you like, you then move forward with a specific lender.

The Critical Juncture: This final step is where you must be vigilant. When you decide to formally apply with a specific partner lender found through Traceloans.com, that lender will almost certainly perform a hard pull on your credit report. This is standard practice across the entire lending industry and is necessary for them to give you the final approval and the money.

Your Action Plan: Safeguarding Your Score on Loan Marketplaces

Using a service like Traceloans.com can be smart, but a proactive approach is your best defense. Here is your checklist for a safe journey.

1. Always Confirm the Inquiry Type

This is your mantra. Before you hit “submit” on any form, look for clear language. Reputable sites will state something like: “Checking your rates will not affect your credit score” or “This is a soft pull pre-qualification.” If you can’t find this assurance, be wary.

2. Be a Terms & Conditions Detective

Yes, it’s tedious, but it’s essential. When you are redirected to a partner lender’s website, take a moment to scan their application page. Look for their privacy policy and terms of service. Specifically, search for phrases like “hard credit inquiry,” “credit pull,” or “authorization to check your credit.” This is your final warning before a potential hit to your score.

3. Vet the Partners for Privacy and Security

Your data is precious. Before providing sensitive information, ensure the websites you are on are secure. Look for the padlock symbol in the browser’s address bar. Furthermore, research the lender’s reputation. A quick search for “[Lender Name] reviews” can reveal a lot about their customer service and data handling practices.

Comparing Your Options: A Quick-Reference Table

| Feature | Traceloans.com (Marketplace) | Direct Bank Loan |

|---|---|---|

| Initial Credit Check | Soft Pull (Typically) | Hard Pull |

| Impact on Credit Score | No Impact for Prequalification | Immediate Impact |

| Loan Options | Multiple offers from partners | Single offer from one bank |

| Best For | Shopping around for the best rates | Customers already loyal to a specific bank |

The Infographic in Your Mind: The Loan Application Journey

Picture this process as a road trip:

- You Start at Traceloans.com: You get your map and check the traffic (soft pull). No toll is paid.

- You See Several Routes (Lenders): You compare the estimated time and cost (loan terms) for each route.

- You Choose a Highway: You decide to take a specific lender’s route. At the on-ramp, you pay a small toll (hard pull) to enter.

- You Reach Your Destination: You get your loan and the journey is complete.

The goal is to stay on the “soft pull” map for as long as possible while you compare your options.

Real-World Scenario: Maria’s Car Loan Search

Maria needs a $10,000 car loan. She’s worried about her credit, which is still recovering. Instead of applying directly at three different banks and getting three hard pulls, she uses Traceloans.com.

She gets prequalified offers from two lenders in minutes, with no impact on her score. She chooses the one with the lower APR. Only when she formally applies with that specific lender does a hard pull occur. By using the marketplace, she contained the credit impact to a single hard inquiry, saving her score from unnecessary damage.

Conclusion: Empower Yourself, Don’t Fear the Process

The relationship between “traceloans.com credit score” doesn’t have to be a mystery filled with anxiety. These marketplaces are powerful tools designed to empower you, the borrower. They let you shop from the comfort of your home without immediately jeopardizing your financial standing.

Your 3 Takeaways for Today:

- Embrace the Soft Pull: Use platforms that offer no-impact prequalification to shop and compare with confidence.

- Always Verify Before the Final Step: The moment you move from prequalification to a formal application, expect a hard pull. Read the fine print every single time.

- Your Data is Your Responsibility: Prioritize security and privacy by using secure sites and researching lender reputations.

By being an informed consumer, you can leverage the convenience of online loan marketplaces to your advantage. What’s the first question you’ll ask before filling out your next loan application?

You May Also Read: The Power of a Protocolo Operacional Padrao

FAQs

Does using Traceloans.com directly lower my credit score?

No, using Traceloans.com for the initial prequalification process should not lower your score, as it typically uses a soft credit pull. The potential for a score impact comes later, if you choose to proceed with a formal application from a partner lender.

How can I be 100% sure a lender won’t do a hard pull?

You can’t be 100% sure without reading their terms, but a reputable prequalification process will always be a soft pull. The key is to understand that a formal application for a loan will always require a hard pull from that final lender.

What’s the main benefit of using a service like Traceloans.com?

The main benefit is efficiency. Instead of submitting multiple individual applications (and multiple hard inquiries) to different banks, you can see multiple potential offers with a single, no-impact soft inquiry.

If a hard pull happens, how much will my score drop?

The impact varies for everyone, but a single hard inquiry might lower your FICO Score by typically less than 5 points. However, multiple hard pulls for the same type of loan within a short shopping period (usually 14-45 days) are often counted as a single inquiry to minimize the damage while you rate-shop.

What information do I need to provide for prequalification?

You’ll typically need to provide basic personal and financial details, such as your name, address, income, and the loan amount you’re seeking. You should not need to provide your Social Security number for the initial soft pull prequalification on a trustworthy site.

Are the loan offers on Traceloans.com guaranteed?

No, prequalified offers are not guarantees. They are conditional offers based on the soft pull. The final approval and terms are subject to a full application and a hard credit check by the lender.

I have a bad credit score. Is Traceloans.com worth trying?

Yes, it can be. Many loan marketplaces work with lenders that cater to a range of credit profiles. A soft pull prequalification allows you to see if any lenders are willing to work with you without further damaging your score, making it a low-risk way to explore your options.